🔖 Leaving A Bookmark

Articles, ideas and/or investment stories we think are interesting (06.08.2024). Not investment or financial advice.

Disclaimer: Nothing we write or say should be taken as investment or financial advice.

🔖 US Colleges Closing, Why?

Headline: Philadelphia Arts College With $50 Million of Muni Debt to Shut

Declining birthrates leads to there being fewer total students 📉

Share of the population that is < 18 down from 25.7% in 2000 to 22.3% in 2019

Smaller, less selective, private schools most at risk 😓

Isn’t this problem only going to get worse as time goes on (sans immigration)?

Any relation to younger generations not wanting to take out student debt? Or focusing more on technical “trade school” degrees less prone to AI disruption?

Consolidation of higher education? (i.e., Northeastern buys Marymount Manhattan)

🔖 Hertz Going Bankrupt (Again)? Turo IPO?

Headline: Hertz Weighs $700 Million Sale of Secured Debt, Convertibles

Hertz’s big electric vehicle (EV), specifically Tesla, bet goes bad

Customers don’t want to rent EVs, plus EVs expensive to run as rental cars

Expensive to pivot, selling Tesla fleet (EV fire ⚡🔥 sale)

Hertz needs more cash to fill “gaps”

Stock is down 78% over last 12 months 🤔

Whatever happened to Turo’s IPO? Seems like they are still planning to go public and can make an actual profit (is growth slowing though?)

Source(s): Bloomberg, TechCrunch, Google Finance, Securities & Exchange Commission (SEC),

🔖 Investors Like “Buy Now, Pay Later” Debt

Headline: Debt Markets Are Fueling Buy Now, Pay Later Resurgence

PayPal, Klarna, Affirm, Australia’s Zip packaging Buy Now, Pay Later (BNPL) consumer debt portfolios into securitizations

KKR signed agreement with PayPal for some of its European BNPL loans, Klarna has secured similar debt in private deals, according to Bloomberg

Bloomberg reports debt packages sold typically comprised three tranches — senior, mezzanine and junior 🍰

BNPL are interest free consumer loans (as long as it’s paid back on time ✅) that people use to fund smaller to medium ticket purchases (i.e., Peloton bike)

Merchants pay BNPL providers commissions for facilitating purchase (i.e, Peloton might not be able sell bike without BNPL financing product)

BNPL relatively new, growing market that hasn’t been tested over an economic cycle? Unclear what default rates will look like if economy slows? 🤷

Credit card 90 day delinquency rates spiked in Q1, wouldn’t BNPL follow same trajectory? 💳💳💳

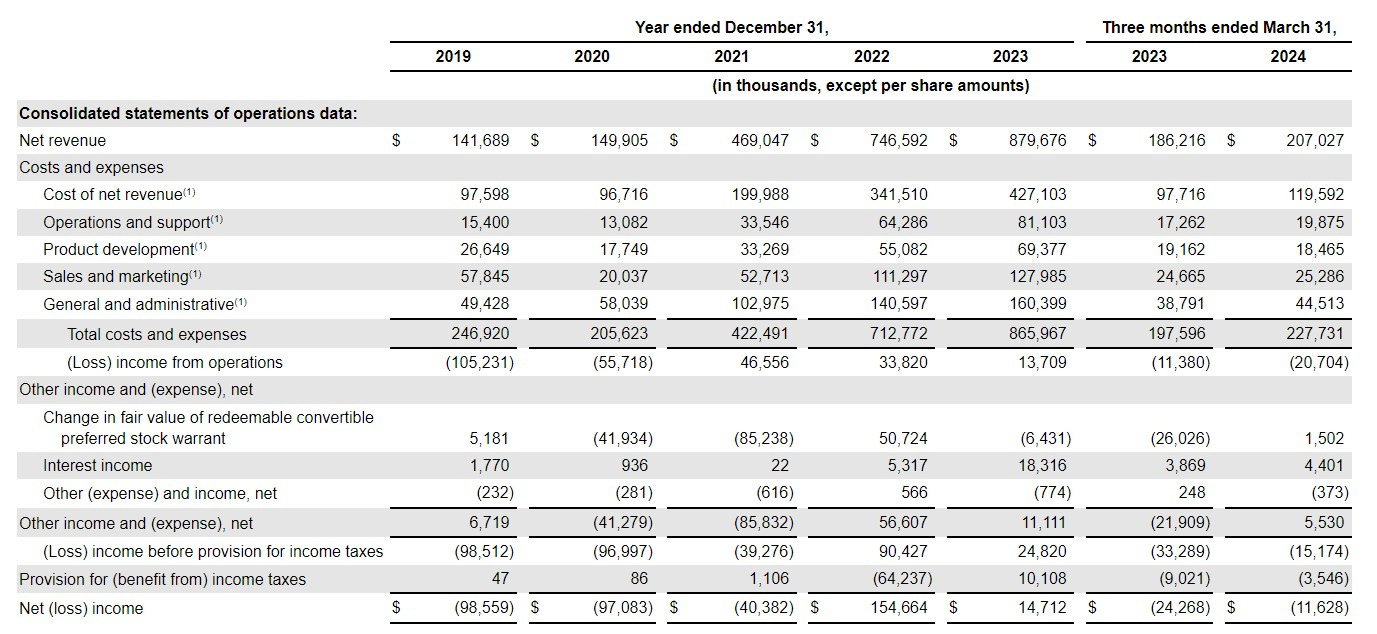

BNPL-focused Affirm down 74% since Jan 2021 IPO, up 59% over last 12 months and down 35% YTD 📉📈📉

Source(s): Bloomberg, New York Federal Reserve