🔖 Bajaj Finance, Kitty vs. Buffett, Tiny's Stock Comp Lesson, Tesla Needs More Models

Articles, ideas and/or investment stories we think are interesting (06.10.2024). Not investment or financial advice.

Disclaimer: Nothing we write or say should be taken as investment or financial advice.

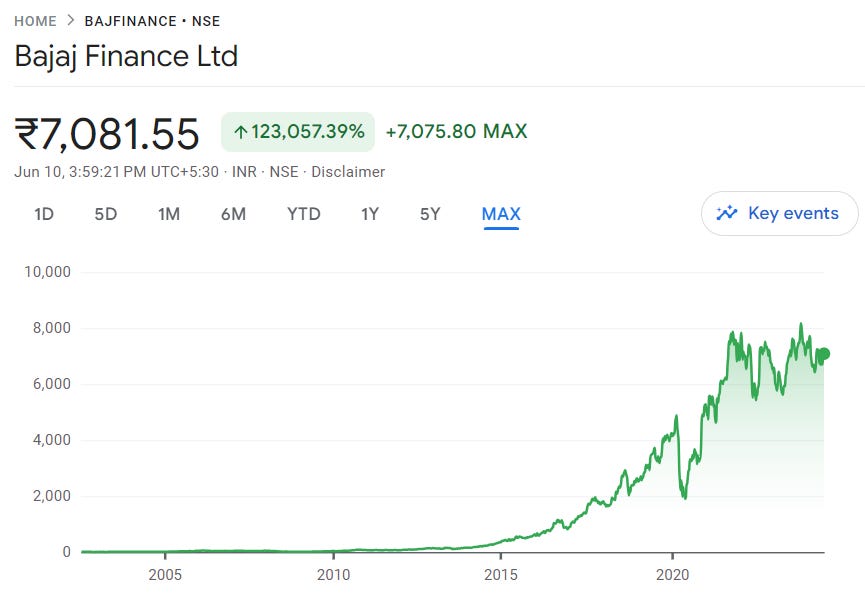

🔖 Bajaj Finance: Indian Consumer Finance Giant, EMI = BNPL

Headline: Saurabh Mukherjea - Bajaj Finance: Strategies of a Lending Giant (Podcast on Colossus’ Business Breakdowns)

Saurabh Mukherjea is the founder and CIO of Marcellus Investment Managers and gives a ~1 hour crash course 📖👏 on Bajaj Finance (BFL)

BFL is a publicly listed, “non-bank” consumer finance giant in India with ties to the Bajaj Group, a large conglomerate that originally made its name in scooters

~60% 👀 of India’s consumer durable loans are made by BFL, ~1 in 5 non-bank loans (TAM = ~$250 billion) is made by BFL (i.e., ~$40+ billion loan book)

EMI (“Equal Monthly Installments”) product was an innovation and is basically another term for a BNPL (“Buy Now, Pay Later”) no-interest advance

Business model makes money by charging merchant for sales conversion

BFL has huge dataset (i.e., 50 million app downloads) and can underwrite a loan in 90 seconds! ⏱️

“Aspirational Indians”, who can’t get a loan from traditional banking system, are less likely to default on their loans 💡

⚠️ Non-performing loans went from 2% in 2007 to 12% in 2009! Indian growth story is powerful, but this needs to be tracked

“So you just do the math on that, 200 million Indians times 1,000 data points, Bajaj Finance's database has 200 billion data points inside it. This data lake is getting churned every day. And especially when we get to festive season in India, our equivalent to Christmas is Diwali, the data lake almost explodes.”

- Saurabh Mukherjea, Marcellus Investment Managers

Source(s): Colossus, Google Finance

🔖 Kitty vs. Buffett

Headline: Confident Communicators: What Roaring Kitty and Warren Buffett can teach us about the games we play

Great piece on behavioral finance (😇, 😌, 😰, 😑, 😡, 🫠)

It can be argued there are some similarities, in psyche at least, between seemingly irrational “meme stock” speculators and fans of Warren Buffett

“Easy enough to point out in a meme stock, but does a stock like Berkshire not share some of the same elements? If it underperforms, you have a community to share the pain. You can excuse yourself because you’re riding with Buffett and “who could have known.” In this case, the shadowy villains are not evil short sellers but bubble maniacs (or the Fed...) whose irrational behavior rewards the stocks you don’t own.”

- Frederick Gieschen, The Alchemy of Money (Newsletter)

Source(s): The Alchemy of Money by Frederick Gieschen (Substack)

🔖 Tiny’s Stock Comp Lesson

Andrew Wilkinson, Co-Founder of Tiny, a publicly-listed Canadian internet & tech-focused holding company shares the company’s 2023 annual report

Section on lessons learned from incentivizing executives with stock options is interesting. Net-net it’s a bad idea! 🤔 (nuanced though)

Source(s): Never Enough Newsletter by Andrew Wilkinson, Tiny Ltd. 2023 Annual Report

🔖 Tesla Needs More Models

Headline: It Really Is All About the Product

Tesla is different than traditional car companies in many ways

One, not so obvious way (at least to us), revolves around the limited number of models it offers vs. competitors, to sell the same number of vehicles (units)

Think about BMW and all of its model series (1, 2, 3, 4, 5, 7, 8, X1, X2, X3, X4, X5, X6, X7, etc., etc.) to sell a similar number of cars that Tesla is selling with just a handful (S, 3, X, Y 🏩)

The ability to pull this off might be coming to an end as more EV options become available and Tesla faces more true competition 🥊 (EV vs. EV, not ICE vs. EV)

According to studies (and common knowledge?), people like variety and design updates (“restyling”) when it comes to their cars

Does everyone want to (not mind) driving the same car, similar to how people might view buying an iPhone? 🤔

Source(s): Car Charts by Glenn Mercer (Substack)